The Wickedness of the 2% Inflation Target

A Modest Benchmark Becomes Economic Trap

In recent weeks, the Federal Reserve (Fed) 2% inflation target has come under increased scrutiny. With inflation holding steady at approximately 2.9% despite a high interest rate of 4.5%, questioning the attainability of this goal under current market conditions. Despite the Fed’s relatively high interest rate of 4.5%, inflation has remained stubbornly above its 2% target, stabilizing near 2.9% for several months. This suggests that the forces driving inflation—whether from supply chain issues, labor market tightness, or consumer demand—are not responding as rapidly to monetary tightening as in previous cycles. The debate has become even more intense as bipartisan elected officials, alongside President Trump, urge the Fed to reduce interest rates in an effort to stimulate economic activity. By law, the Fed is responsible for promoting financial stability, supervising and regulating banks, and overseeing the payments system. However, its primary responsibility is the “dual mandate,” which requires the Fed to control inflation (price stability) and minimize unemployment (maximum sustainable employment). The main tool the Fed wields to achieve these objectives is monetary policy—specifically, adjusting the interest rate, which influences borrowing costs, investment decisions, and overall economic activity.

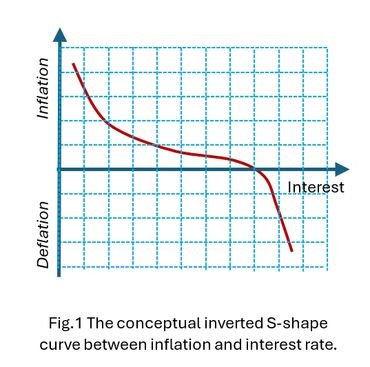

The US economy is an intricate system in which inflation, interest rates, and the risk of recession are interrelated. Understanding how these variables influence one another is crucial for both policymakers and participants in the economy. The relationship between inflation and interest rates is observed as an inverted S-shape curve (Fig.1). While this conceptual model illustrates both variables are linked, their relationship is not linear nor straightforward. In general, when interest rates are lowered, the borrowing costs go down makes money more accessible to businesses and households. Thus, it upturns investments, consumer spending increasing the overall demand placing upward pressure on prices and leading to higher inflation. However, this does not continue indefinitely. At extremely low levels of interest rates, the economy can overheat, causing inflation to accelerate at a rate that may become difficult to control. Conversely, when interest rates are increased, borrowing costs rise. This reduces credit availability, which discourages spending and investment. Lowering spending may suppress inflation, but if the rates are raised too sharply or held high for prolonged periods, economic activity can contract, potentially leading to deflationary pressure. In certain scenarios, the relationship between interest rates and inflation can become less predictable, as other economic forces—such as consumer expectations, global price shocks, or technology changes—come into play.

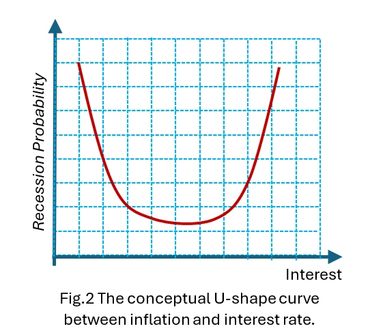

The connection between interest rates and the probability of recession is often described as a U-shaped curve (Fig. 2.) This means that both excessively low and excessively high interest rates can elevate the risk of economic downturns, though for different reasons.

At Low Interest Rates, when borrowing is cheap and credit is easy to obtain, asset bubbles may form, and inflation may accelerate. If inflation surges or asset bubbles burst, the economy can quickly slip into recession. Conversely, high interest rates make credit expensive and scarce. Investment slows, consumer spending contracts, and unemployment may rise as businesses cut back. The resulting drop in demand may cause the economy to shrink, triggering a recession. Thus, both ends of the interest rate spectrum pose recession risks, while the ideal lies somewhere in a moderate range that supports sustainable growth without igniting inflation. Cautious must be taken when adjusting the interest rate, as it may cause recession. The Fed’s dual mandate requires it to balance the competing goals of low inflation and low unemployment.

The Complexity of the US Economy

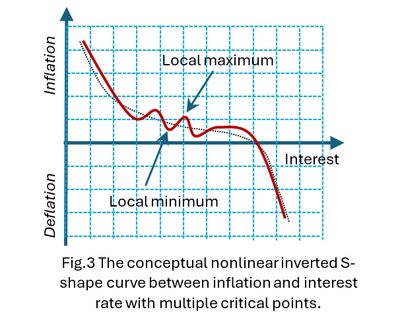

The Fed faces a formidable challenge when adjusting interest rates, primarily because the U.S. economy is a highly complex, nonlinear, and time-varying system. Nonlinear systems, by their nature, do not respond predictably to intervention. Small changes or disturbances can push the system off track, cause instability, or result in the economy settling into unintended but stable conditions—referred to as critical points. Furthermore, as a time-varying system, the economy continually evolves, shaped by technological progress, demographic shifts, and global influences. Thus, monetary policy strategies effective in the 1990s may no longer yield similar results today, as the underlying system itself has transformed. Given this dynamic complexity, the Fed must execute its monetary policy with extraordinary delicacy and caution. This is where the analogy with control systems engineering becomes illuminating. In control theory, engineers regulate intricate systems—such as aircraft, industrial robots, or even climate control—by measuring crucial variables and feeding this information back into a controller, which then adjusts specific control inputs to guide the system toward desired outcomes. Similarly, the Fed relies on an array of economic indicators—such as CPI (consumer price index), PPI (producer price index), unemployment rates, and GDP growth—as sensors that provide continuous feedback about the state of the economy. The Fed itself acts as the controller, manipulating the primary control variable: the federal funds interest rate. The ultimate objective is to steer the economy toward outcomes that align with its dual mandate—maximum sustainable employment and stable prices.

The Fed’s policy is fundamentally data dependent. It continuously monitors a broad spectrum of economic indicators, interpreting them as real-time feedback that informs every policy decision. This ongoing process ensures that policy adjustments are responsive to the latest developments and emerging risks, rather than being based solely on forecasts or outdated models. Controlling a nonlinear, time-varying system requires more than static rules or fixed strategies. In engineering, adaptive controllers are employed to deal with systems whose dynamics evolve over time and whose responses to input are not straightforward. These controllers continually update their actions based on real-time feedback, learning and adapting to ensure the desired trajectory is followed.

Remarkably, the Fed’s approach mirrors the adaptive sliding mode controller—a sophisticated control strategy where the controller constantly nudges the system (the economy) along a desired path by adjusting the control variable (interest rates). One core challenge is minimizing “chattering,” or the deviation from the desired trajectory. If the controller is too aggressive or too slow to adapt, the economy can overshoot targets or settle into undesirable, yet stable, states.

When the Fed decides to adjust interest rates incrementally- searching for an optimal point that satisfies its mandate- implicitly employs a procedure akin to the gradient descent algorithm in optimization. In this approach, small, iterative changes are made to gradually approach the minimum (or maximum) of a function- in this case the optimal economic outcome.

However, gradient descent is not without its drawbacks. One issue is the risk of missing the true optimal point, especially if the adjustment steps are too large or the economic environment is turbulent. This challenge is analogous to excessive “chattering” in control systems. By refining the size of interest rate changes and carefully interpreting data, the Fed can reduce this deviation, though this often introduces a time lag in reaching the optimal policy stance.

Another complication arises from the possibility of becoming “trapped” in a local minimum or maximum—a stable but suboptimal condition where the system settles (Fig.3.) For the economy, this could mean inflation stagnation: a scenario where even high interest rates fail to bring inflation down because the nonlinear system has found a new equilibrium. Escaping such traps may require unconventional policy tools or coordinated action beyond traditional rate adjustments.

The years preceding the COVID-19 pandemic, the Fed maintained inflation close to the targeted 2% rate—a figure now widely recognized as the “sweet spot” for modern central banking. The Fed formally adopted the 2% inflation target in 2012, following years of deliberation about the best way to foster price stability and maximum sustainable employment. By anchoring expectations at this level, the Fed offered predictability, which in turn fostered moderate yet reliable economic growth. GDP growth consistently outpaced both inflation and prevailing interest rates, supporting job creation and justifying the servicing of national debts. The dollar remained strong, attracting foreign investment and bolstering global confidence in US markets. The emergence of COVID-19 in early 2020 upended this equilibrium. The labor market became exceptionally tight, and the supply chains worldwide faced severe disruptions, exacerbating shortages in goods and driving up costs. In response, the US government initiated a massive stimulus program. Approximately $5 trillion was injected into the economy. These measures were taken to avert deeper recession that would shape the economic landscape for years to come. The result was a dramatic increase in inflation, which soared to 8.0% in 2022, it is the highest in four decades (Table 1). Adding insult to injury, the geopolitical conflict due to the Russian invasion to Ukraine exacerbated to inflation. The high spike in inflation forced the Fed to increase interest rates incrementally by 525 basis points. The interest rate reached 5.5% in August 2023 (Table 2). The Fed’s goal was to reach the desired 2% inflation goal smoothly and without hitting a recission (soft landing). It took several major interest rate hikes of 75 basis points in 2022. Once inflation started cooling, the Fed started lowering the interest rate in September 2024 to control inflation. The Fed has been holding interest rate unchanged at 4.5% since December 2024. Clearly, the fed is using the sliding mode controller strategy, where it wants to keep the economy moving along a desired trajectory using the gradient descendant method to search for the optimum condition.

The important question now is: Will the US economy reach the 2% inflation target in a timely manner? How long will the interest rate remain high at 4.5%? And how should the Fed move forward with its monetary policy?

Will the US economy reach 2% inflation target in a timely manner?

The 2% inflation is optimal for the US economy as it supports moderate growth and supports economic sustainability due to high US national debts. We argue that this goal cannot be easily achieved in the short run. We argue that the Fed should set a higher inflation target at 2.5% or even 3.0% until things cool off. In the following, we will list why the 2% target is very challenging in the short run. Instead, we argue the Fed should start lowering interest rates while the inflation stagnates at 3.0%.

1- The new tariff policy: It is intuitive that adding tariff will increase prices, which increases inflation. Some of the tariff cost will be absorbed by the manufacturer (abroad), some will be absorbed by the US businesses as production cost, and some will be passed to the consumer. Make no mistake, the US economy will experience higher prices because of the tariff policy, with transitory inflation of 0.5% across the board. The good news is that tariffs will generate onetime transitory inflation instead of persistent inflation. Recent reports indicated that inflation due to tariffs will continue to slowly ramp up in the next three to six months before fading away. We argue that inflation due to tariffs will add a few 10s of basis points despite the interest rate. On the other hand, keeping the interest rate at its current rate has a counter impact on the US economy and the GDP growth, as the interest rate has been above the US growth for over two years. This may cause instability in the long run.

2- The US economy in 2025 is a complex, nonlinear dynamic system characterized by multiple stable points (local minima): This paradigm of economic complexity is evidenced by the divergence in sectoral performance, persistent inflation above target, and the apparent ineffectiveness of traditional monetary tools to push the system toward a global optimum. Acknowledging its intricate interdependencies, feedback loops, and the presence of multiple equilibria. Unlike pre-COVID era, when changes in interest rates produced more uniform and predictable effects across sectors. The US economy’s current behavior suggests that it rests in a suboptimal local state as the inflation remains stubbornly above the Federal Reserve’s 2% target. This persistence is not merely a function of monetary inertia but a feature of the current configuration of sectoral performance and aggregate demand. By 2025, however, two powerful forces have reshaped this landscape. First, the rise of the technology sector— due to its high profit margins and its high levels of cash reserves— has decoupled a significant portion of growth from monetary policy. Second, the outsized role of financial markets, buoyed by a more profitable environment at higher interest rates, has created an asymmetrical response: some sectors flourish, while others languish.

The current situation of the US economy can be modeled as resting in a local minimum—a suboptimal point with relative stability. At this juncture, the aggregate system achieves equilibrium at 3% inflation, not the targeted 2%. We can argue that incremental adjustments to the interest rate (either up or down) would fail to remove the system from this condition. The mechanism is rooted in sectoral divergence. As interest rates rise, the financial sector expands its profit base, a crucial constraint shaping these dynamics is the aggregate debt burden. As of 2025, total US debt stands at approximately $77 trillion, divided among $37 trillion for the government, $20 trillion for businesses, and $20 trillion for households. Higher interest rates, while bolstering the financial sector, serve as a drag on heavily leveraged sectors such as real estate, consumer goods, and utilities. Another feature of the current landscape is what might be called “counterintuitive pricing.” As consumer demand falls (a result of high rates and low housing activity), businesses in the consumer sector must raise prices to reach breakeven. This runs contrary to expectations that lower demand should pull prices downward. Instead, fixed costs and the need to preserve margins force prices upward, sustaining inflation despite weak consumption. The housing market stagnates, and unfortunately it will remain stagnated until it becomes affordable.

On the other hand, lowering rates would also prove ineffective. It would enable businesses to raise prices further to preserve or expand profit margins, again sustaining inflation above the 2% target. This configuration is suggestive of a system at a local minimum, where the pain of moving away from the current state (via lower interest rates or higher rates) is distributed asymmetrically, with only marginal gains or, worse, new inefficiencies. The economy is “stuck,” not for lack of policy effort, but because the topology of the economic landscape has changed. Aggregating the sectoral performance reveals a net sum at 4.5% interest rate. The real risk is not runaway inflation or a deflationary spiral, but prolonged mediocrity—an economy stable but not thriving; stuck at a local minimum.

3- The burden of high interest rates on the US national debts: As of August 2025, the US national debt has soared to an unprecedented $37 trillion, equating to approximately 124% of the country’s gross domestic product (GDP). Of which $6 trillion is short-term debt in the form of Treasury Bills, while $15 trillion is tied up in Treasury Notes with maturities ranging from two to ten years. The remainder is distributed across longer-term bonds and other obligations. This alarming debt-to-GDP ratio is having a deeper macroeconomic challenge, especially in an environment characterized by lower economic growth (Table 3.) Year-to-date, the federal government has paid $1.02 trillion in interest alone, a reflection of the 3.35% average interest rate on its outstanding obligations. For context, the US economy is currently growing at a modest 2.1%, a figure that falls short of the average interest rate on the debt. The current US scenario, with a 3.35% interest rate and only 2.1% GDP growth, portends a troubling trajectory. One of the cardinal rules of sustainable government finance is that the economic growth rate should at least match or exceed the average interest rate on government debt on the long run. However, when the interest rate on government borrowing surpasses the GDP growth rate, the debt burden can spiral.

Summary:

A 2% inflation rate is commonly viewed as favorable for the US economy, promoting moderate growth and price stability. Maintaining an interest rate of 4.5% for more than two years may impact on the stability of the US economy, potentially extending the time needed to achieve the 2% inflation target. We argue that the new tariff policy results in a slight increase in prices independently of interest rates. At a 4.5% interest rate, we argue that the US economy may experience a local equilibrium where 3% inflation stagnation acts as a stable suboptimal condition. We argue the economic stagnation arises from sectoral dynamics, with rapid growth in financial and technology sectors contributing to overall growth, while the demands of the other sectors are dropping making businesses increase their prices caused by the shift in breakeven points. Consequently, inflation is stabilizing at 3%. Additionally, high levels of national debt can add costs and affect growth rates. Economic sustainability is typically associated with GDP growth that equals or exceeds interest rates. As a result, we argue to move the inflation target temporarily from 2% to 3% allowing for lowering interest rates and supporting growth rate to be above interest rate. We argue this adjustment may allow room for the transitory tariff-related inflation to be absorbed and potentially increase housing supply and affordability.

© 2026-2025 The High-Tech Tribune - All Rights Reserved.